Stockholder’s Equity Retained Earnings Kilgore Company experience the following events during it’s first accounting period Issued common stock for $5,000 cash Earned $3,000 of cash revenue Paid a $4,000 cash to purchase land Paid cash dividends amount to $ Paid $2,200 of cash expenses

ACTG CH. 1 Flashcards | Quizlet

None of the answers describes this event., Sims Company earned cash revenue by providing services to its customers. This event is A. an asset source transaction. … Simpson Company paid cash to purchase land. … Daemon Company paid cash to purchase land. Which of the following shows how this event will affect the company’s accounting equation?

Source Image: cnbc.com

Download Image

Sign Up Subjects Business Accounting Asset Simpson Company paid cash to purchase land. This event is: a) an asset source transaction. b) an… Question: Simpson Company paid

Source Image: coursehero.com

Download Image

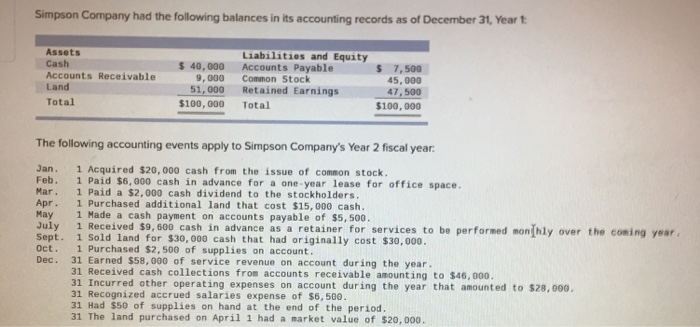

Solved Simpson Company had the following balances in its | Chegg.com Simpson Company paid cash to purchase land. This event is – an asset exchange transaction Sims Company earned cash revenue by providing services to its customers. This event is – an asset source transaction. Sims Company received cash from the issue of a note payable to a bank. This event is – an asset source transaction. Sims Company received

Source Image: issuu.com

Download Image

Simpson Company Paid Cash To Purchase Land This Event Is

Simpson Company paid cash to purchase land. This event is – an asset exchange transaction Sims Company earned cash revenue by providing services to its customers. This event is – an asset source transaction. Sims Company received cash from the issue of a note payable to a bank. This event is – an asset source transaction. Sims Company received Sep 4, 2023The event of Simpson Company paying cash to purchase land is an asset source transaction. An asset source transaction refers to an event where a company acquires cash from an external source to increase its assets.

Toys n Playthings by Lema Publishing – Issuu

This event is, Sims Company received cash from the issue of a note payable to a bank. This event is, asset source transaction and more. … Simpson Company paid cash to purchase land. This event is. an asset exchange transaction (paying cash for land causes an increase in one asset account 9land) and a decrease in another asset account (cash The Star: December 03, 2020

Source Image: yumpu.com

Download Image

Why is US tax revenue as a percentage of GDP so stable? – Quora This event is, Sims Company received cash from the issue of a note payable to a bank. This event is, asset source transaction and more. … Simpson Company paid cash to purchase land. This event is. an asset exchange transaction (paying cash for land causes an increase in one asset account 9land) and a decrease in another asset account (cash

Source Image: quora.com

Download Image

ACTG CH. 1 Flashcards | Quizlet Stockholder’s Equity Retained Earnings Kilgore Company experience the following events during it’s first accounting period Issued common stock for $5,000 cash Earned $3,000 of cash revenue Paid a $4,000 cash to purchase land Paid cash dividends amount to $ Paid $2,200 of cash expenses

Source Image: quizlet.com

Download Image

Solved Simpson Company had the following balances in its | Chegg.com Sign Up Subjects Business Accounting Asset Simpson Company paid cash to purchase land. This event is: a) an asset source transaction. b) an… Question: Simpson Company paid

Source Image: chegg.com

Download Image

Financial Bubbles | PDF Sep 3, 2023question No one rated this answer yet — why not be the first? 😎 raajratan Final answer: The correct answer is Option B. The event of Simpson Company paying cash to purchase land is an asset use transaction. Explanation:

Source Image: slideshare.net

Download Image

Is Zapp Brannigan (Futurama) a sequel to Troy McClure (The Simpsons)? – Quora Simpson Company paid cash to purchase land. This event is – an asset exchange transaction Sims Company earned cash revenue by providing services to its customers. This event is – an asset source transaction. Sims Company received cash from the issue of a note payable to a bank. This event is – an asset source transaction. Sims Company received

Source Image: quora.com

Download Image

Calaméo – The Moment August 2021 Sep 4, 2023The event of Simpson Company paying cash to purchase land is an asset source transaction. An asset source transaction refers to an event where a company acquires cash from an external source to increase its assets.

Source Image: calameo.com

Download Image

Why is US tax revenue as a percentage of GDP so stable? – Quora

Calaméo – The Moment August 2021 None of the answers describes this event., Sims Company earned cash revenue by providing services to its customers. This event is A. an asset source transaction. … Simpson Company paid cash to purchase land. … Daemon Company paid cash to purchase land. Which of the following shows how this event will affect the company’s accounting equation?

Solved Simpson Company had the following balances in its | Chegg.com Is Zapp Brannigan (Futurama) a sequel to Troy McClure (The Simpsons)? – Quora Sep 3, 2023question No one rated this answer yet — why not be the first? 😎 raajratan Final answer: The correct answer is Option B. The event of Simpson Company paying cash to purchase land is an asset use transaction. Explanation: